By October, foreign investors operating within Gujarat International Finance Tec-City, also known as GIFT City, may be able to trade sovereign green bonds.

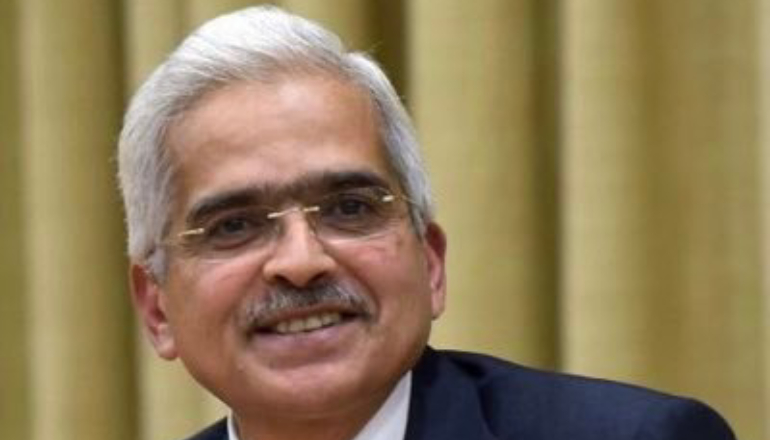

RBI Governor Shaktikanta Das affirmed the development. He said that trading of sovereign green bonds can start at International Financial Services Center (IFSC). “We are in discussions with the IFSC on allowing investment in green bonds. It should be operationalized by the second half of FY25.”

Currently, foreign portfolio investors (FPIs) registered with SEBI are permitted to invest in green bonds, The investments can be under the different routes available for investment by FPIs in government securities.

It must be noted that RBI had in April announced that it will allow investment and trading of Sovereign Green Bonds at IFSC,.

“With a view to facilitating wider non-resident participation in green bonds, it has been decided to permit eligible foreign investors in the IFSC to also invest in such bonds,” Mr Das said during the April bi-monthly policy.

Finance Minister Nirmala Sitharaman announced in FY25 Budget speech that a climate finance taxonomy will be developed to enhance capital availability for climate adaptation and mitigation.

Recalling here, the Union Budget of FY 23 announced sovereign Green Bonds for green infrastructure mobilization.

The objective was to reduce carbon intensity by introducing Sovereign Green Bonds to help the Indian government secure funding for sustainable public sector projects.