The climate clock is ticking in India.

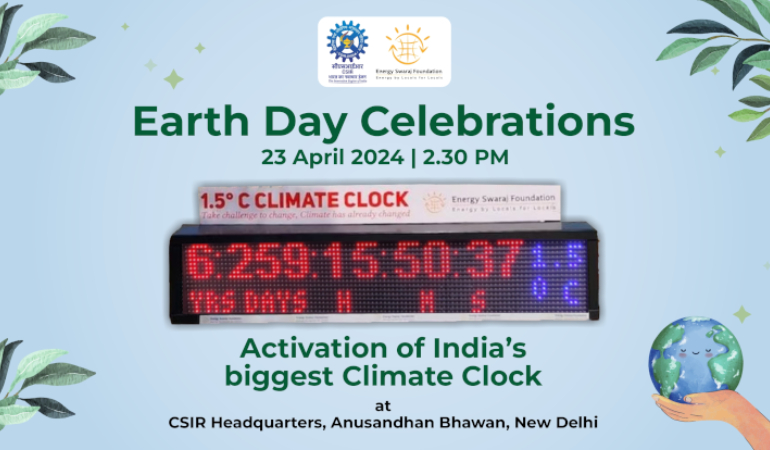

The CSIR installed India’s largest climate clock at its headquarters for Earth Day celebrations, aiming to raise public awareness about climate change’s harmful effects.

The climate clock provides real-time data on global temperature increases, indicating irreversible consequences if they exceed 1.5°C. It also tracks the deadline for achieving zero emissions and the lifelines for key solution pathways, providing crucial global data.

The Intergovernmental Panel on Climate Change (IPCC) warns that global warming beyond 1.5°C will pose a significant threat to over 3 billion people in highly vulnerable areas.

Amid a Climate Emergency, immediate action is crucial to prevent catastrophic climate impacts. The next 7 years offer the best opportunity for transformational global economic changes.

Prof. Chetan Singh Solanki, founder of the Energy Swaraj Foundation, emphasized the need for energy literacy among citizens to minimize energy usage.

Dr. Shailesh Nayak, former Earth Science Secretary and Director of the National Institute of Advanced Studies, delivered a lecture on triggered earthquakes in Koyna, part of the CSIR AMRIT program aimed at gaining insights from top scientists.

Dr. N Kalaiselvi, DG-CSIR, emphasized environmental protection on Earth Day, stating that many CSIR scientists and employees completed Energy Literacy Training and installed Climate Swaraj Foundation-supplied climate clocks in labs.