Forty percent of public companies are reporting scope-3 emissions.

According to a recent report by investment data and research provider MSCI, more and more public companies worldwide are disclosing about their greenhouse gas emissions footprints.

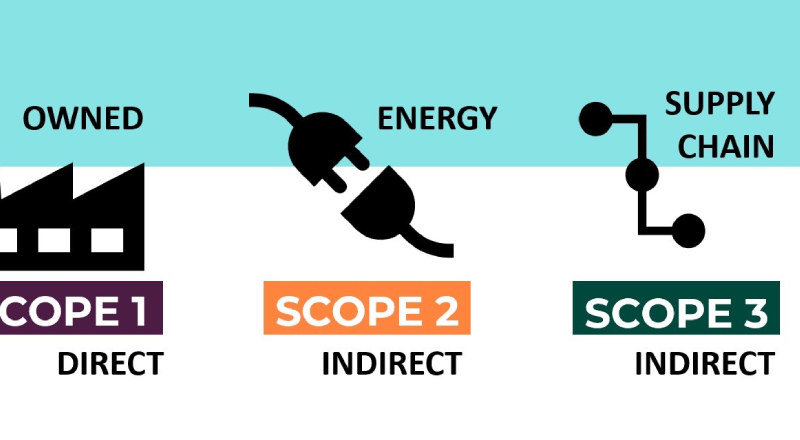

Almost 60% of them reported on Scope 1 and 2 emissions, which is an increase of 16 percentage points in the last two years. The number of companies reporting on at least some of their Scope 3 emissions has increased to 42% from 25% two years ago and roughly 35% last year. This indicates that the pace at which value chain emissions are being reported is growing even faster.

The MSCI report revealed that more businesses are establishing goals for reducing their emissions and that although the rate of goal-setting has slowed, the quality is rising, with a notable increase in decarbonization targets supported by science.

The report showed a stark discrepancy in disclosure between American and international corporations. For example, only 45% of American public companies reported on Scope 1 and 2 emissions, while 73% of companies in developed markets outside of the United States did the same. Similarly, only 29% of American public companies reported on Scope 3, whereas 54% of their counterparts in developed markets did the same.

Goal-setting:

According to the report, despite a slowdown in goal-setting, businesses are still setting climate targets. By the end of January 2024, 38% of companies had declared a net zero target and 52% of companies had disclosed an emissions reduction target, up 1% from the previous year. The quality of climate targets seems to be improving, even though the pace of target setting has slowed. As of 2020, only 1% of companies had set science-based targets aligned with 1.5°C, compared to 20% last year.

MSCI noted that although listed companies’ greenhouse gas emissions seem to have leveled off, they have not decreased despite advancements in disclosure and target setting. The study predicts that in 2024, the direct operational greenhouse gas emissions of the world’s listed companies, or Scope 1, will remain constant at 11.8 billion tons, or almost one-fifth of all greenhouse gas emissions worldwide. Listed companies are currently headed for a 3°C temperature increase this century, according to MSCI’s Implied Temperature Rise metric. Only 38% of companies are on a 2°C or lower pathway, with 11% aligned with 1.5°C.

According to the UN’s Intergovernmental Panel on Climate Change (IPCC), to prevent the worst effects of climate change, global emissions would need to peak by 2025 and then decline by 7% a year until 2030.

The advancement in emissions reporting is being complemented by the expansion of regulatory mandates for climate-related disclosures across various jurisdictions. The EU has introduced new disclosure requirements, while nations are adopting sustainability reporting systems based on IFRS International Sustainability Standards Board’s Scope 1, 2, and 3 reporting standards. The SEC requires reporting on larger companies’ operational emissions but has halted implementation due to legal challenges.