MSMEs’ awareness of sustainability has grown, with a stronger focus on environmental measures in Q2 2024. A new Dun & Bradstreet and SIDBI Sustainability Perception Index (SPeX) for April to June 2024 shows that MSMEs value sustainability initiatives for profitability and brand image.

Highlights of the report:

As per the analysis, a larger section of medium and small firms believe sustainability efforts can improve brand image (89%), boost stakeholder appeal (88%) and profitability (84%), though they (78%) are less confident about cost reduction.

Implementation in Q2 2024 has improved over the past quarter, with microbusinesses leading in implementing sustainability practices.

The percentage share of micro-firms reporting implementation in Q2 2024 compared to Q1 2024 saw the highest increase in four categories: training on sustainability measures, compliance, sourcing from ethical suppliers, and recycling practices.

Sustainability initiatives by firms vary by age. In case of internal sustainability initiatives, younger (less than 1 year) and older MSMEs (more than 25 years) engage more on environment related measures. While MSMEs aged between 1-25 years revealed focusing on labour welfare.

For external sustainability initiatives, old (more than 25 years) and younger MSMEs (less than 5 years) are mostly involved in community welfare. While MSMEs aged between 5-25 years are engaged with activities related to the development of the environment of the local community.

Challenges and drivers:

Despite the increased awareness, MSMEs face challenges in quantifying the benefits of sustainability investments, with many concerned about returns from sustainability initiatives and having limited familiarity with social aspects of sustainability.

Global client demand is a primary driver for medium and small firms to adopt sustainability practices, while high costs, availability of capital, and lack of technical expertise are major challenges across all firm sizes.

Trends:

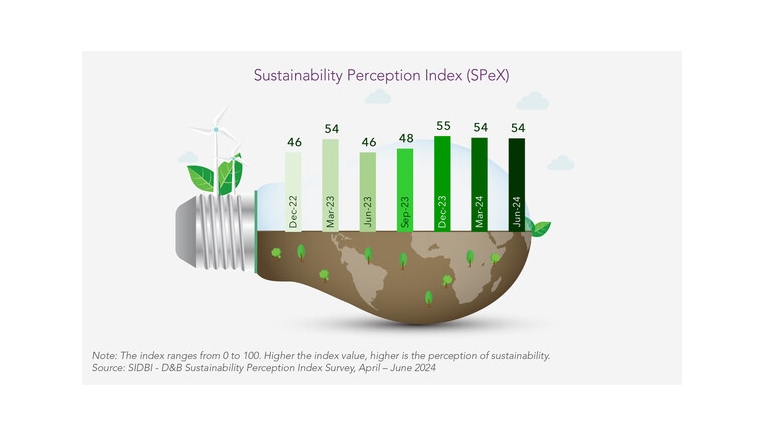

In this quarter, the SPeX value remained steady at 54. The awareness dimension led with a score of 59, a 9% increase, while implementation rose 35% to 49. However, overall awareness dropped 17% to 51. Implementation improved compared to the previous quarter, with micro businesses at the forefront of adopting sustainability practices. The percentage of micro firms reporting implementation saw highest increases in four key areas like training on sustainability measures, compliance, sourcing from ethical suppliers, and recycling practices.

The C-suite comments:

Dr. Arun Singh, Global Chief Economist, Dun & Bradstreet, said, “Over the past year, MSMEs have become more aware of sustainability, particularly of environmental measures, and are increasingly recognizing the profitability and cost-saving benefits of sustainable practices. However, high costs, availability of capital, and difficulty in quantifying benefits make them hesitant to deepen their expertise. To overcome these barriers, it’s crucial to reduce the cost of adopting sustainable practices and increase funding, especially for cleaner production and recycling technologies. The government’s initiative to create Climate Finance Taxonomy as announced in the Union Budget in July 2024 will be key in directing capital toward climate-resilient infrastructure, aiding MSMEs in achieving energy efficiency and emission reduction targets”.

Dr. R.K Singh, CGM, SIDBI stated, “SPeX endeavours to be a tracker of MSMEs’ intent and preparedness to go for green investments. This also helps us to customize our solutions aimed at inducing MSMEs to align to value chain expectations on responsiveness. SIDBI – D&B Sustainability Perception Index Survey, April – June 2024 indicates slight stability in the SPeX score, indicating the need to effectively scale up and augment the capacity building, orientation and awareness on enterprise side. The level of implementation needs a fillip across all sizes of enterprises. SIDBI has prioritized the Greening of Enterprise Ecosystem. SIDBI’s Panchtatva missions viz. Energy Efficiency, E-Mobility, Renewable Energy, Circular Economy and Adaptation Finance (Nature based Solutions) are oriented to enhance the acceptability amongst MSMEs to ‘Go Green’ and adopting Environmental & Social (E&S) practices for holistic improvement in the enterprise thereby making more resilient, competitive, sustainable operations / practices / products / services.”